Sophisticated Investment Opportunities

Optimal Tax Advantages

Tax Benefits of Energy Investments

A federal tax law introduced in the 1980s has promoted the production of domestic energy resources. Investing in oil and gas development ventures creates tremendous tax benefits.

Innovative Energy Development

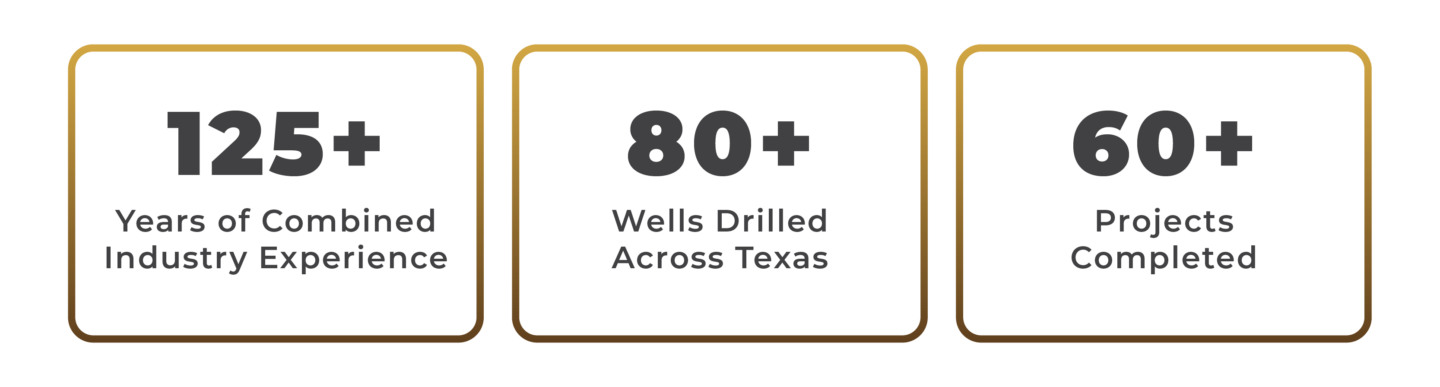

Founded in 2006, Millennium is a dynamic developer of oil and gas-producing properties throughout the Texas Gulf Coast Basin. It boasts a resume of over 60 executed projects spanning 28 Texas counties.

Find out how our proprietary, patent-pending exploration process sets us apart from other oil and gas development companies.

Professional Partnership

We work with thousands of investors and trade partners on thousands of mineral acres of public and private land. Whether you’re a project generator, a mineral owner, an investor, or a trade partner, our goal is the same: work one-on-one to create a long-lasting partnership built on mutual trust.

Investor Educational Resources

Want an easy-to-understand explanation of your oil and gas drilling project? Take a look at our educational videos on the energy development process. We’ve developed these tools to empower investors with the knowledge to make informed decisions.

Developing Energy Producing Properties from Concept to Cash Flow

Transparency And Simplicity

Industry leadership, long-term relationships, and a dedicated team of trusted experts enable us to thrive in oil and gas investments and exploration developments. As a result of our straightforward and broad experience, we have provided our investors with access to new, potential opportunities through oil and gas projects since 2006.

Doing Nothing Has A Cost

By not investing in oil and gas, investors are missing out on the diversification benefits this asset class can provide. Oil and gas investments have a low correlation with other asset classes, meaning they tend to perform differently than traditional investments. This can also reduce an investor’s ordinary taxable income.